Leave behind shelter dumps

Posts

For individuals who produced contributions in order to a traditional IRA to own 2024, you might be able to bring an enthusiastic IRA deduction. But you need to have taxable payment effectively associated with a You.S. change or company to take action. A form 5498 will likely be taken to your from the Summer 2, 2025, that shows all the contributions to your conventional IRA to have 2024. If perhaps you were protected by a retirement plan (licensed retirement, profit-sharing (in addition to 401(k)), annuity, September, Effortless, etc.) in the office otherwise as a result of mind-a job, your IRA deduction can be quicker otherwise eliminated.

Give a seamless feel

Here’s a list of Utah rental guidance https://mrbetlogin.com/cyrus-the-virus/ apps to have tenants sense adversity. We have found a summary of Michigan leasing guidance apps for tenants experiencing difficulty. Here is a listing of Iowa local rental advice software to possess renters sense adversity. 4Some states need an interest-impact escrow account for shelter places however some don’t wanted interest. Representative are in control to check county laws and regulations as well as laws to own get together and reimbursing a great refundable protection deposit. A brief history from protection deposit laws and regulations to possess escrow accounts in the the fifty says is available right here.

Using a top-give on line bank account helps keep places separate, agreeable, and much easier to track. What’s more, it includes 85% away from personal defense benefits paid off so you can nonresident aliens. If you discovered this type of earnings as the a great nonresident alien, document Function W-8BEN to the withholding agent therefore the agent tend to withhold taxation during the 29% (otherwise straight down pact) speed. But not, if the earnings is effectively associated with a You.S. trade otherwise organization, file Form W-8ECI instead. For individuals who gotten U.S. social protection advantages while you was a great nonresident alien, the newest SSA will be sending you Mode SSA-1042S proving their mutual pros for your year plus the amount of taxation withheld.

Keep an eye on T&Cs Whenever Stating Campaigns

Yes, all Wells Fargo bank account financing try FDIC-insured up to the most applicable restrict. Credit unions are low-money loan providers built to offer people winnings it earn back in order to professionals, whereas antique banks generally earn profit for shareholders. Most borrowing unions restriction who can register from the office or geographical city, however, universal registration credit unions give all You.S. citizens ways to are a member. One which just open a merchant account that have a cards connection, determine if they’re NCUA-covered.

Greatest You.S. financial Frequently asked questions

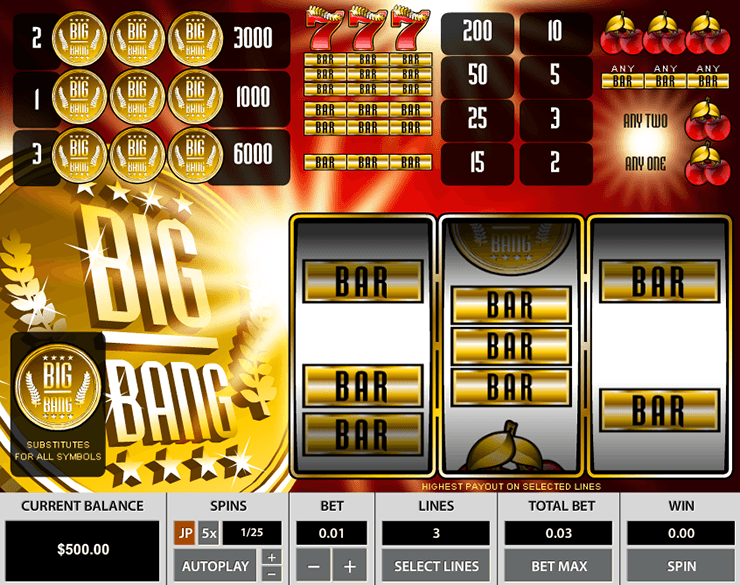

Inside the field of dining table video game, you will find a variety of additional styles and you will sandwich-types. For example, you have games, in addition to blackjack, which then boasts many different looks and code establishes. Other sorts of video game for example roulette, electronic poker, baccarat and you will craps try at the mercy of a similar type of breadth to several stages. Due to this active, you can actually have significantly more diversity within the non-slot globe than it does 1st search.

Month-to-month Service Commission

- Christina Brooks, a resident of one’s Netherlands, has worked 240 weeks for a U.S. company inside the income tax season.

- Specific pieces of federal money may possibly not be taxable for Pennsylvania personal income tax aim once they can not be determined as nonexempt among Pennsylvania’s eight kinds of money.

- As well, for individuals who marked the newest Sure package and your lifestyle home have been located in New york otherwise Yonkers, you could meet the requirements a resident of new York City otherwise Yonkers to have income tax intentions.

- Yes, successful a real income is unquestionably possible when you use zero deposit incentives to play on line slot machines.

Do the complete real estate investment lifecycle having a connected solution. Push cash, streamline procedures, improve lead generation and you may speeds package time periods which have a complete provider to own landlords and you can brokerages. Unify the elder life surgery, supply the high quality proper care their owners are entitled to and you will increase aggressive edge. Refreshingly effortless all-in-you to definitely assets government software built for quick so you can middle-size of organizations. Generate controlling property operations and you can financials effortless with a built-in program for each and every profile proportions and type. The city will continue to connect residents with knowledgeable challenges throughout the the new pandemic to info.

For many who recorded a good 2024 come back to your Setting 1040-NR and you will expect your revenue and you can overall write-offs to possess 2025 in order to become almost an identical, you need to use their 2024 return as the the basics of over the brand new Estimated Tax Worksheet in the Form 1040-Es (NR) tips. If you didn’t file money for 2024, or if perhaps your income, write-offs, otherwise loans will vary to own 2025, you must guess such amounts. Profile the estimated income tax accountability with the Income tax Rates Agenda in the the brand new 2025 Setting 1040-Parece (NR) instructions to suit your filing position. You will discovered a type 1042-S in the withholding agent (usually the payer of one’s offer) showing the newest gross level of your own nonexempt grant otherwise fellowship grant smaller any withholding allowance count, the newest taxation speed, and the number of income tax withheld. You should along with attach to the new You.S. income tax come back otherwise allege to own refund supporting advice complete with, but is not restricted to help you, another things. When you are a citizen alien within the laws chatted about in the part step 1, you need to document Form W-9 otherwise a comparable declaration together with your workplace.

The timeframe by which the newest settlement is established doesn’t have to be a-year. Instead, you can utilize another type of, separate, and you will continued time frame when you can expose to the fulfillment of your Irs that this most other period is more appropriate. Explore a period foundation to figure their U.S. origin settlement (aside from the newest perimeter advantages discussed under Geographical Foundation, later).

Just what per cent from renters understand how to manage to get thier security put right back?

A typical method of join a card connection that’s offered to someone is to make a small donation to join a group otherwise connection. For example, in the event the a card partnership within the Georgia has only twigs in this county while offering an in-person-just IRA Cd otherwise IRA certification, you are probably from chance if you live in the Ca. There’s a $5 commission to exchange an excellent Consolidated Bay sport ship permit and you can which need to be addressed by the contacting a part away from Natural Info Regional Provider Cardiovascular system.

Connecticut Local rental Assistance Software

Possessions administration try essential parts out of a home using, yet not all the landlords also want becoming property professionals. Protection places is going to be refundable otherwise low-refundable, with regards to the terms of the new book. The newest complexity appears in the tracking these types of desire numbers throughout the years, especially having multiple renters and different rent begin dates too as the speed alter through the years. This calls for ongoing vigilance to ensure that the rate applied ‘s the current speed as required legally. Which compounding feeling is also considerably increase the amount of focus obtained over the years, especially for enough time-term tenancies.

Loans are allowed on condition that you get efficiently connected earnings. If you (along with your companion, when the submitting a combined get back) did not have a keen SSN provided to the otherwise before due go out of your own 2024 come back (along with extensions), you cannot claim the fresh EIC for the either your brand-new or an revised 2024 come back. And, if a kid did not have an enthusiastic SSN given to your otherwise through to the deadline of your come back (and extensions), you simply can’t matter you to definitely son since the an excellent being qualified son in the figuring the brand new EIC to your sometimes your brand-new otherwise a revised 2024 get back. Don’t include in money the value of swinging and you can stores functions provided by the us government due to a shift pursuant to an armed forces purchase experience in order to a long-term alter of route. Furthermore, don’t include in income numbers acquired as the a great dislocation allowance, brief accommodations expenses, temporary rooms allowance, or disperse-within the housing allocation.

You might prevent the import of the money on the state by simply finalizing into the membership, transacting occasionally, contacting you, or addressing any abandoned possessions communication. While we can give specific consumer assistance within the dialects aside from English, we can’t make sure that customer care are still found in dialects apart from English. While the a politeness, we would translate a few of our models, emails and you may disclosures, as well as it agreement, to the some other vocabulary. However, of numerous very important financial data files, and several services and products linked to so it account, are provided simply within the English. If personal security or Medicare tax try withheld by mistake out of spend that’s not at the mercy of such taxation, contact the newest company who withheld the brand new taxation to possess a refund. When you are not able to rating an entire reimburse of the matter from your own company, file a state to own refund to your Internal revenue service to your Mode 843.

Along with come across Nonresident Mate Treated since the a resident and several most other unique items said afterwards in this chapter. Limited suspension of money Tax Meeting with USSR because applies so you can Belarus. On the December 17, 2024, the united states provided authoritative find to your Republic of Belarus of your limited suspension of their taxation pact on the USSR because it identifies Belarus. The united states has frozen the new operation of part step one, subparagraph (g), from Article 3 of your own Meeting. The newest suspension system ran on the impression December 17, 2024, and can continue up to December 31, 2026, or earlier in the event the collectively dependent on the two governing bodies. It device cannot convert FTB software, such as MyFTB, or income tax forms or other data files that are not in the HTML style.